In this section you will find useful information on how to import new products in erplain via a product import template:

TABLE OF CONTENTS

- Prerequisites

- Tips for new users

- Opening the template (for CSV files only)

- Understanding the logic of the template

- Uploading my file back into erplain

- Error messages

Prerequisites

Stock locations are not created by the import. We invite you to create/edit your stock locations beforehand in erplain. In a second time, fill in your file with the existing stock locations.

Tips for new users

If it is your first time importing products, we recommend that you start creating a couple of products manually directly in erplain. Creating products manually is more intuitive and gives you a better insight on the existing fields that will eventually turn into column names in the template file.

Note: Making mistakes on your first time importing products is very common

For your first import, we suggest you to take baby steps and start by importing just a couple products. Therefore, if you make mistakes, you will be able to re-edit your file much faster.

Note: Importing new products will not delete your products already created in erplain.

Downloading the template

Note: Making mistakes on your first time importing products is very common

For your first import, we suggest you to take baby steps and start by importing just a couple products. Therefore, if you make mistakes, you will be able to re-edit your file much faster.

Note: Importing new products will not delete your products already created in erplain.

Downloading the template

Importing products can be done directly from the menu Settings > Import data, using the template available in both CSV and XLSX format through the link.

From the screen "Import data", select "Products" and click on "CSV" or "EXCEL".

From the screen "Import data", select "Products" and click on "CSV" or "EXCEL".

Opening the template (for CSV files only)

Once the download is complete, open the file "product-import-template.csv" with Google Sheets. To learn how to open and save Google Sheets files, we invite you to watch this video:

Warning: Excel, Numbers an a large majority of spreadsheets are not able to run .csv file in accordance with standards and risk corrupting your file. We invite you to systematically use Google Sheet for your imports.

Warning: Excel, Numbers an a large majority of spreadsheets are not able to run .csv file in accordance with standards and risk corrupting your file. We invite you to systematically use Google Sheet for your imports.

Understanding the logic of the template

The file "product-import-template" is a template made for importing your products. It is at the same time, your model and once customized, your final document. Its format cannot be modified.

The logic behind this document relies on five items.

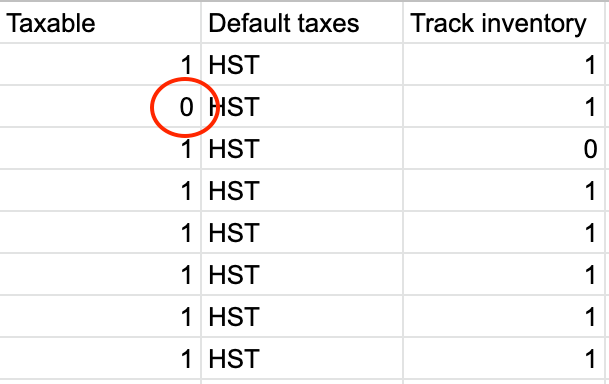

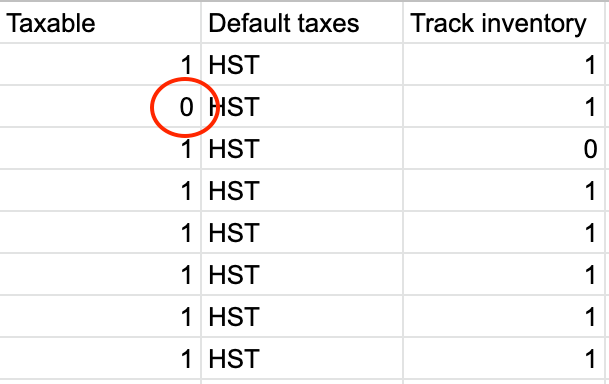

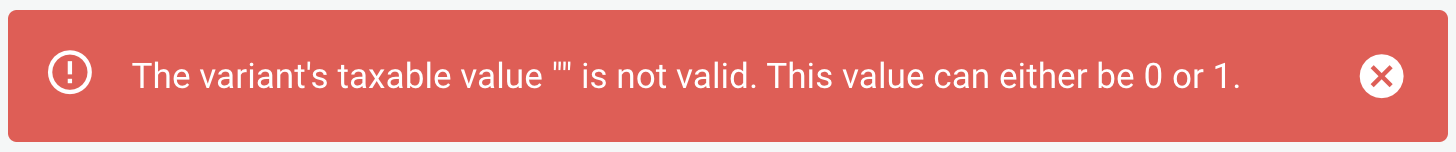

Values 1 and 0: In the columns "Taxable" and "Track inventory", 1 et 0 stand respectively for YES and NO. For exemple for a NON-taxable product, we indicate "0" in the corresponding cell.

The logic behind this document relies on five items.

Values 1 and 0: In the columns "Taxable" and "Track inventory", 1 et 0 stand respectively for YES and NO. For exemple for a NON-taxable product, we indicate "0" in the corresponding cell.

Important: In the columns "Taxable" and "Track inventory", the cells must not be empty.

Products without variant: A product without variant is represented on a single row. It has no option or attribute.

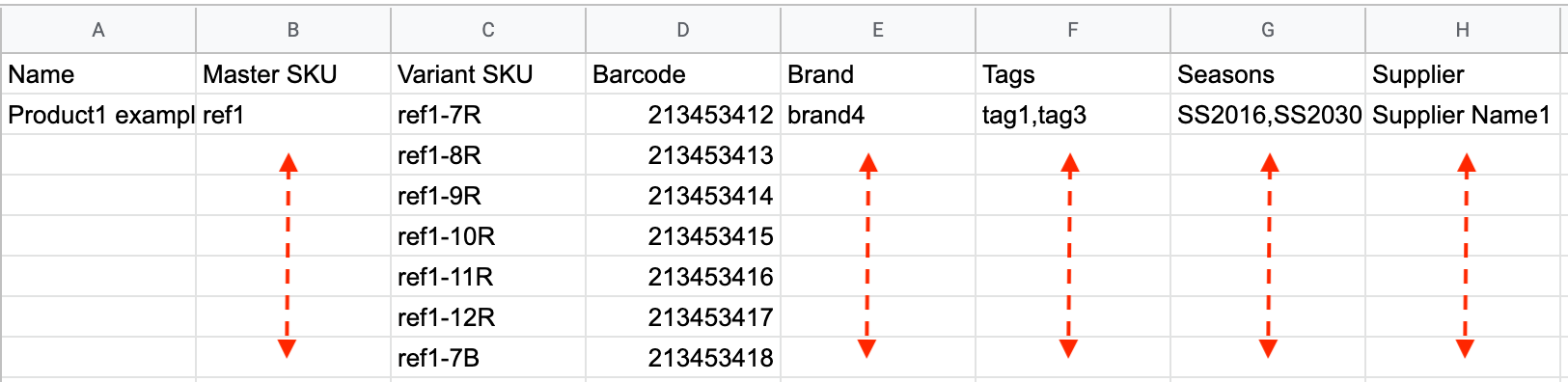

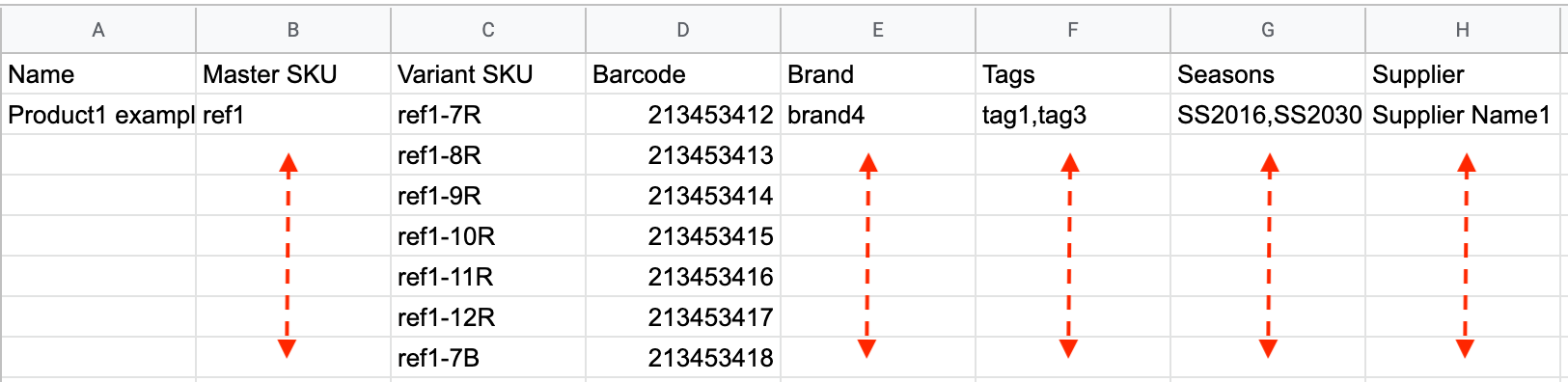

Products with variants: A product with variants is represented by multiple rows. Each row represents a new combination of attributes. The first row also contains all the information about your master product (Name, Master SKU, Supplier, Brand, Tags, Season, Description). It is not necessary to enter this information for each variant (every row). However, the other are customizable at the variant level (Variant SKU, Barcode, Weight, Bin location, Quantity, etc).

Taxes: In the column "Default taxes", the data "HST" corresponds to the tax name that is not to be mixed up with the tax abbreviation.

Stock locations: In the column "Stock location", the data "Default location" corresponds to the default stock location created by erplain at the time your account was set-up.

Products without variant: A product without variant is represented on a single row. It has no option or attribute.

Products with variants: A product with variants is represented by multiple rows. Each row represents a new combination of attributes. The first row also contains all the information about your master product (Name, Master SKU, Supplier, Brand, Tags, Season, Description). It is not necessary to enter this information for each variant (every row). However, the other are customizable at the variant level (Variant SKU, Barcode, Weight, Bin location, Quantity, etc).

Taxes: In the column "Default taxes", the data "HST" corresponds to the tax name that is not to be mixed up with the tax abbreviation.

Stock locations: In the column "Stock location", the data "Default location" corresponds to the default stock location created by erplain at the time your account was set-up.

Uploading my file back into erplain

Once the file is edited and saved, you can upload it to erplain from the menu Settings > Import data > Select file > Import products

Warning: Once your file is selected, click on "Import products". Do not click on "Update products".

Warning: Once your file is selected, click on "Import products". Do not click on "Update products".

Error messages

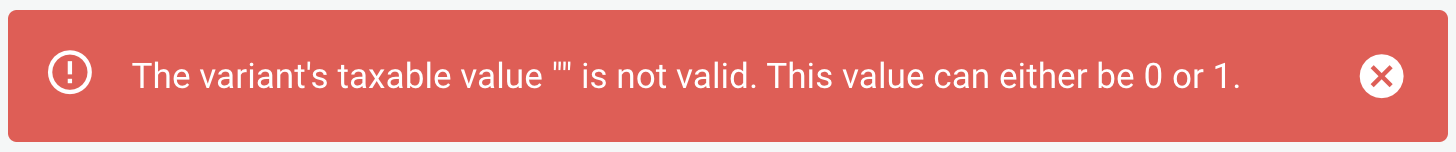

When a mistake is detected in the file, erplain prevents the file from being uploaded and displays an error message, showing you the mistake to be corrected.

Example, with an empty cell in the "Taxable" column:

Example, with an empty cell in the "Taxable" column: