Erplain allows you to track the valuation of your inventory, with several calculation methods available.

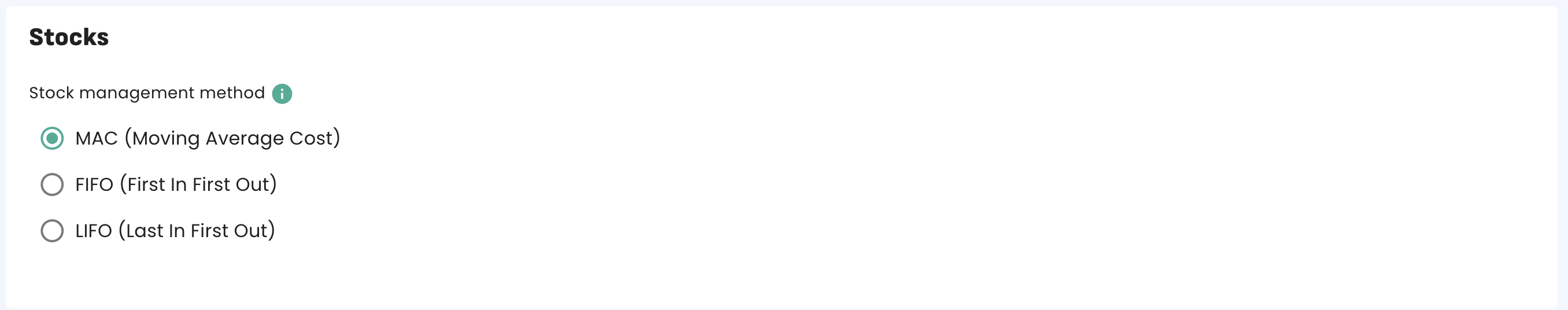

You can choose the valuation method from your company settings.

Note: The purchase price and the cost are two different values.

The purchase price (PP) is the default price used when creating a purchase. The product cost refers to the acquisition or manufacturing cost of a product and can vary each time products are added to inventory.

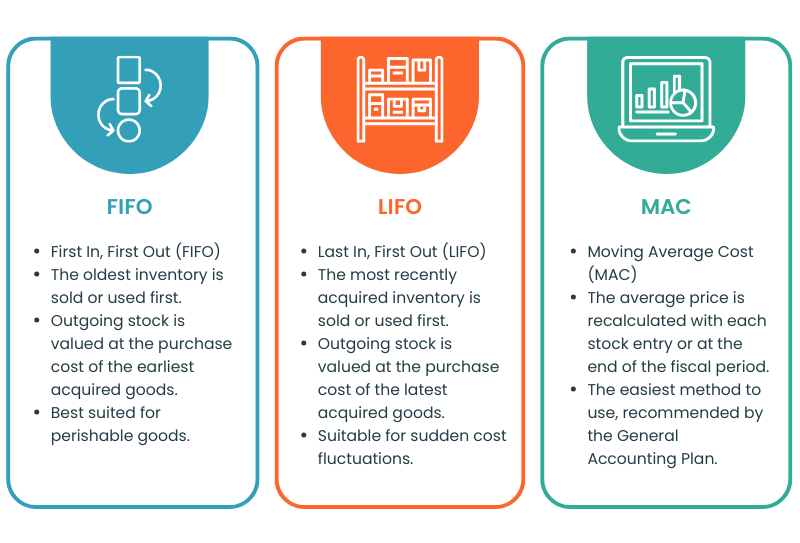

In Erplain, you can use the Moving Average Cost (MAC), the First In, First Out (FIFO), and the Last In, First Out (LIFO) methods to calculate product cost and inventory valuation.

Moving Average Cost (MAC)

Erplain uses the MAC method by default to calculate product cost and inventory valuation. The MAC of each product is recalculated after each purchase, stock entry, or when a new product is created (initial cost). For example, if you create a purchase (or perform a stock entry) for 100 units of product Z at €20 each, and two weeks later you purchase 100 more at €10 each, your MAC will be €15.

First In, First Out (FIFO)

The FIFO method values inventory based on the oldest acquisition costs. The first products purchased (first in) are the first products sold (first out). FIFO is recalculated after each purchase, stock entry, or product creation. Example for product Z: you have an initial stock of 100 units at €10 each, purchase 50 units at €20 each, then sell 100 units. You’re left with 50 units valued at €20 each, i.e. €1,000 total.

Last In, First Out (LIFO)

The LIFO method values inventory based on the oldest acquisition costs. The last products purchased (last in) are the first products sold (first out). LIFO is recalculated after each purchase, stock entry, or product creation. Example for product Z: you have an initial stock of 100 units at €10 each, purchase 50 units at €20 each, then sell 50 units. You’re left with 100 units valued at €10 each, i.e. €1,000 total.

Important: The valuation of each product is only calculated if the real stock is above 0. For example, if your real stock is -6 and you purchase 10 products, the cost will be calculated only on 4 products (10 - 6). If the available stock is below zero, the valuation is still calculated as it is only based on real stock.

Sales

Your inventory valuation is adjusted when the invoice is issued, not when a quote or a sales order is created.

Purchases and supplier receipts

When products are added to stock from a purchase, Erplain calculates inventory valuation using the price recorded in the supplier receipt (created from the purchase order). Valuation is only calculated when products are received in stock, not when the purchase is made.

Delivery costs (purchases)

Delivery-related costs are included in the product cost calculation. For example, if delivery costs are €500 for a shipment of 100 products, then €5 (500 / 100) will be added to the product cost for that transaction.

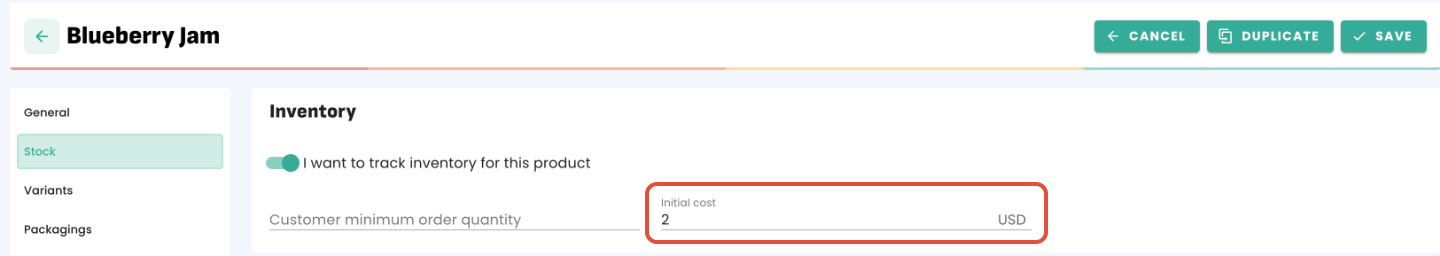

Initial cost

The initial cost (when creating a new product) is the starting point for cost calculation. If you don’t enter an initial cost, it will default to €0. You can update this field by editing the product in the “Inventory” section. Often, during setup, the initial cost may match the purchase price. The initial cost is a unit cost per product and must be in your account’s primary currency.

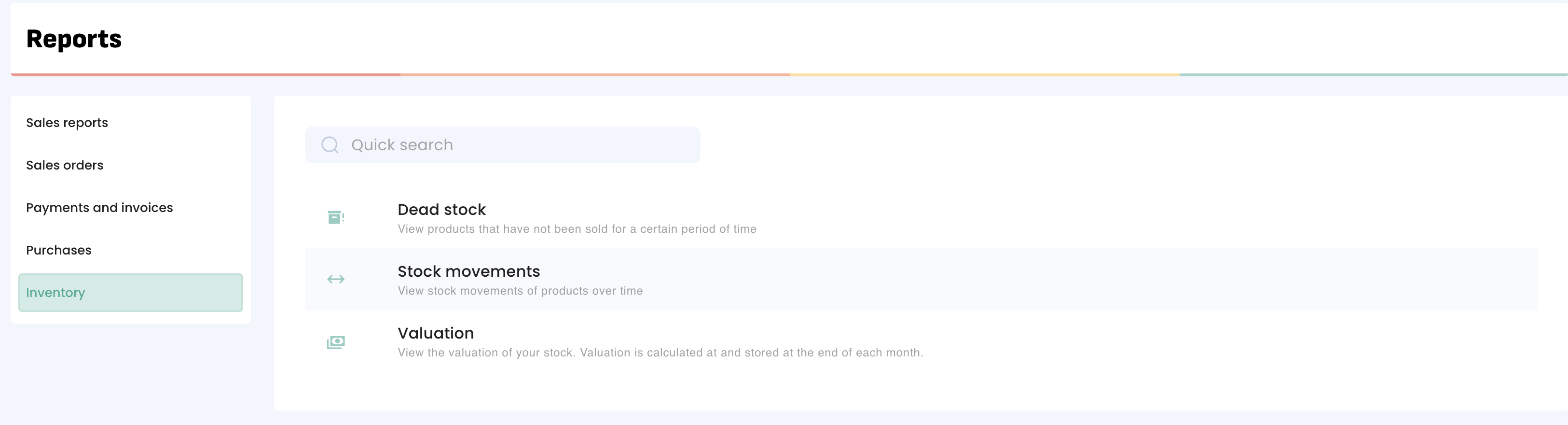

Valuation reports

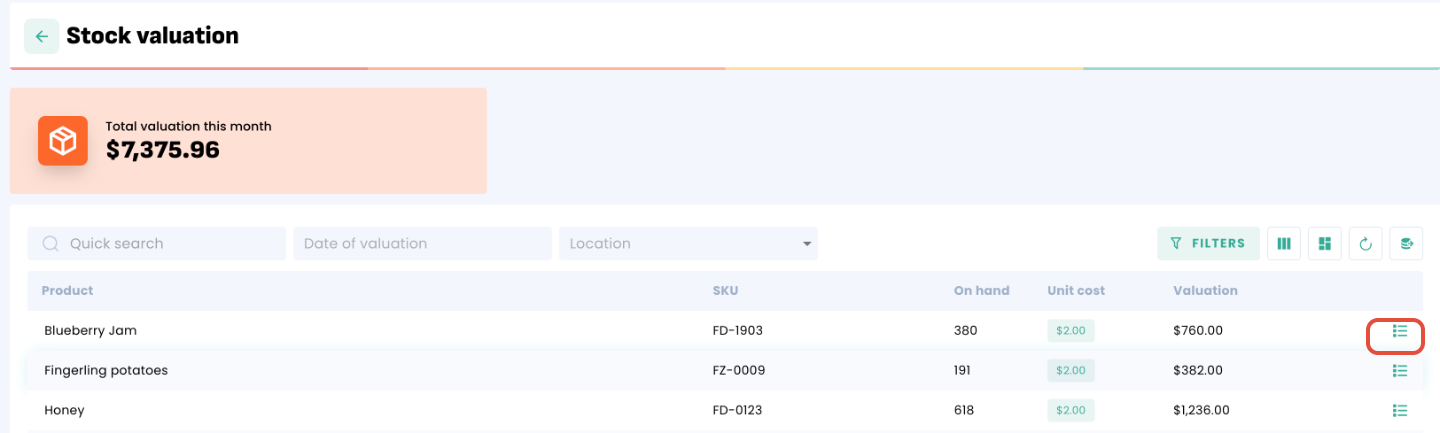

Once your costs are tracked in Erplain, you can check your inventory valuation in the “Reports” > “Inventory” menu. You will see all your products with their current valuation, and you can also select a past date using the “valuation date” field.

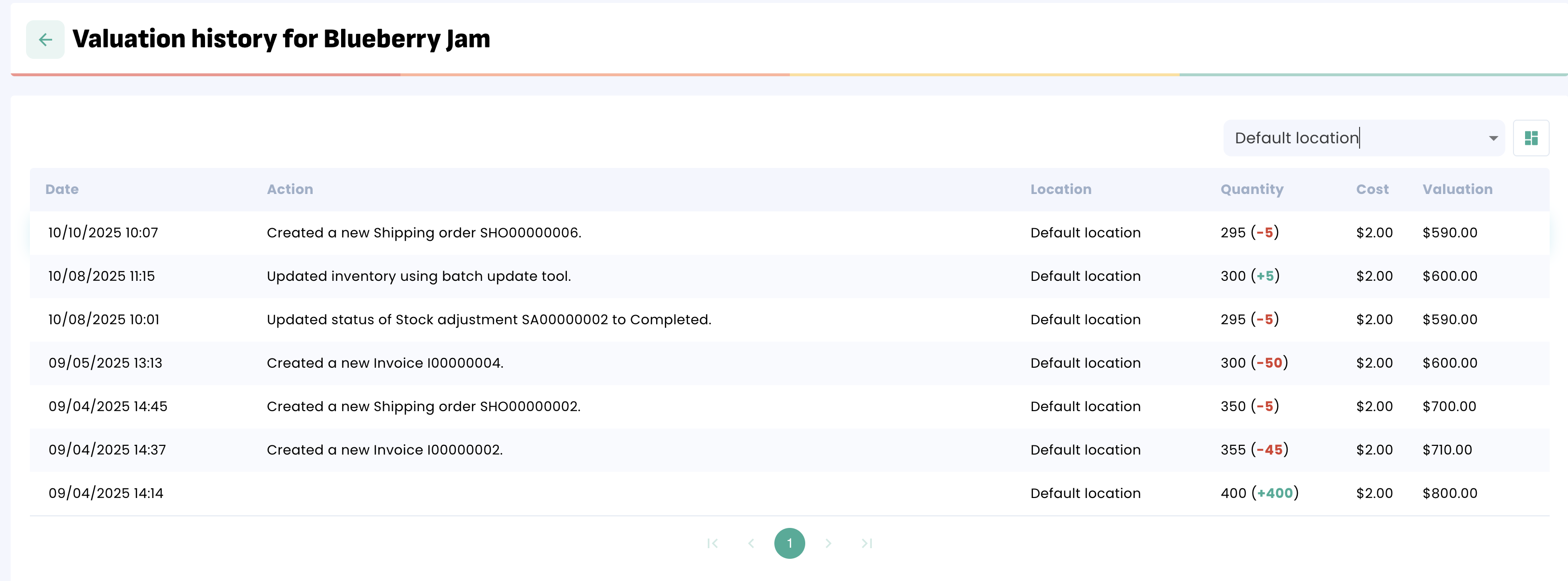

Stock valuation details

To view all transactions that affected the valuation of a product, click the “details” icon.

A window will open showing the history of all transactions included in the calculation: